7 key market segments of digital health in India

Indian healthcare industry enables a large number of openings for innovative start-ups with fresh ideas & disruptive technology. There are 7 key market segments of digital health in India. The need for affordable and quality medical care, along with increasing penetration of smartphones, the Internet in the country and initiatives like Digital Health India, has facilitated a remarkable rise in the number of healthcare start-ups over the last 3-4 years. Indian healthcare industry enables a large number of openings for innovative start-ups with fresh ideas & disruptive technology.

Digital technology endorsement is already getting importance in India’s healthcare industry, with sincere efforts from public and private sectors. There has been a rise in some digital health startups in recent years. Indian healthcare sector is one of the fastest growing fields, and it is expected to reach US$ 300 billion by 2020 with an average growth of 18.3%. [1] Private players have entered the market with products such as wearables & have set up innovation centres across India. [2] The government, on the other hand, launched several initiatives such as Digital India and Aadhaar cards in some cases with support from the private sector. A digital strategy refers to the use of the centralization of multiple applications to disrupt business processes and improve sustainable access to services to all.

Innovations and disruptive technology help to improve patients experience and develop user-friendly solutions. Digital health start-ups are trying to introduce new ways to aid patients and are heavily funding research & development.

| Recommended for you | |

| Future market growth of digital health startups in India | |

| 12 key market applications of digital health startups in India | |

| 50 Digital health events across Europe |

Some of the widely used applications that are being used to create healthcare solutions under the Digital health India program are:

1. mHealth:

mHealth is a mobile extension of the National Health Portal and it provides health services to end-users through an app. [3] Indian residents have probably adopted the mHealth application, and according to the report, they turned out to be quite appreciated. [4] mHealth is one of the leading areas in India with an anticipated market size of INR 2083 crore in FY 2015-16. Mobile applications and devices connecting patients and doctors are vital sections within mHealth. A study also showed that 68% of physicians recommend mHealth & 90% of those patients have surprisingly started using it. It has verified over 90,000 doctors.

2. Telemedicine:

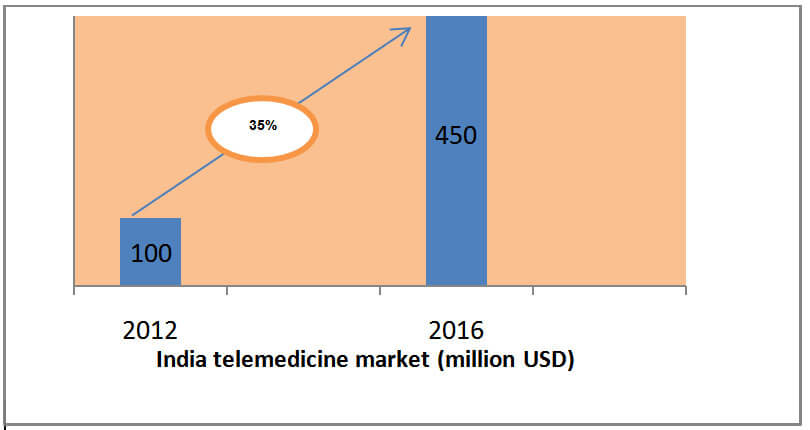

Telemedicine is the use of technology for remote diagnosis, monitoring, and education. It’s considered as one of the main and an independent segment. Telemedicine is another important division of Indian healthcare industry. It is valued at USD 150 million in 2012-13 and projected to grow four times by 2016-17. [5] Digital health start-ups like Portea & Medwell are aiming at healthcare delivery platform due to rise in demands of rehab & elderly care, by providing home visits from doctors, nurses, physiotherapists, etc. Telemedicine has greatly aided in reducing the patient’s costs and providing healthcare to remote areas of India. Private hospitals have also incorporated the services and uniting with the government to open more centres for telemedicine.

Image Courtesy of www2.deloitte.com

3. Remote Diagnosis:

India’s healthcare delivery market valued at USD 8 million in 2012 and anticipated to grow at CAGR of 20 percent [6]. However, there is serious demand for affordable healthcare as most of the Indian population has basic daily income. Products developed for this market helps to increase access to health care for remote and rural populations by providing point-of-care diagnostics, teleconsulting and e-prescription capabilities. The foreign healthcare market is forecasted to reach USD $125 billion by 2020 and keeping this in mind. Digital health start-ups are focusing on the bridging the gap between rural residents and health care providers in urban areas. They aim to hire more than 8, 000 health professionals to act as proxy doctors using services of Con-call & Video conferencing.

4. Wearables:

Earlier, wearables were healthcare devices that could track fitness endeavours to increase diet & exercise results. Nowadays, they mainly used for measuring factors like heart rate and energy levels etc. India’s wearables market size is INR 30 crore, and it is projected to grow as the technology is accessible to the young generation.

5. Appointment management:

End users have begun to use technology to enhance resource utilization within existing infrastructure. Meeting management is gaining grounds in Indian healthcare sector with investors are keen to grasp the opportunity in this segment. Health appointment booking companies attracted funds worth US $315 Million from venture capital firms in 2016-17.

6. Online Pharma:

E-commerce is the most extensive developing sector in India, and it is vitally facilitating the easy accessibility of medicines for residents. Experts believe that it is challenging for this segment to grow due to unavailability of specific regulations and guidelines for eHealthcare.

7. Digital and social connectivity:

Social media usage is growing manifold in India. An average Indian spends about 25% of their time on social media thanks to recent digital push.

While these are relatively concrete in India, some of the technologies that are gaining wider acceptance in the Indian healthcare industry are as follows:

- Big data analytics:

Big Data and Cloud computing are slowly getting recognition in Indian medical sector. Many stakeholders recognised the value of relating the technology with customer insights to improve the health services. - Electronic medical records (EMR):

Hospitals and clinics have increased the use of EMR’s which allowed the usage of new IT systems. They have also favoured the cloud computing and health information systems. It helps in reducing medical errors and improving health outcomes. EHR Adoption includes usage of medical records and other digital solutions for hospitals and physicians. Continued gains are made in physician adoption in EMR systems. CMS’s recent survey shows over 70% of doctors in the U.S. have used EMR. Even the doctors working in rural areas have difficulty in keeping up with medical advancements. Indian medical workforce needs additional education & training as more than half of them are poorly educated. Electronic Health Records (EHR) system with correct guidelines and an integrated decision support system plays a significant role in the training of the workforce. They can also help in improving patient care.

In 2013, EHR standards and guidance was finalized by Government of India. To uplift the adoption of EMR/EHR, the various category of standards like Vocabulary Standards, Clinical Standards, and Interoperability(to exchange the records between hospitals) parameters added in documented policies. All these rules are flexible and modifiable. AIIMS Delhi successfully executed a cloud-based EHR system with a repository of patient records in 2015. It also had the way to automate patient appointment & informing them. For unique identification of the patient, this system recommended Aadhaar card number as a primary key. The total expenditure on IT by theUS hospitals has approximately cost up to $79-80 billion in comparison to healthcare IT spending payments up to $305 million in India.

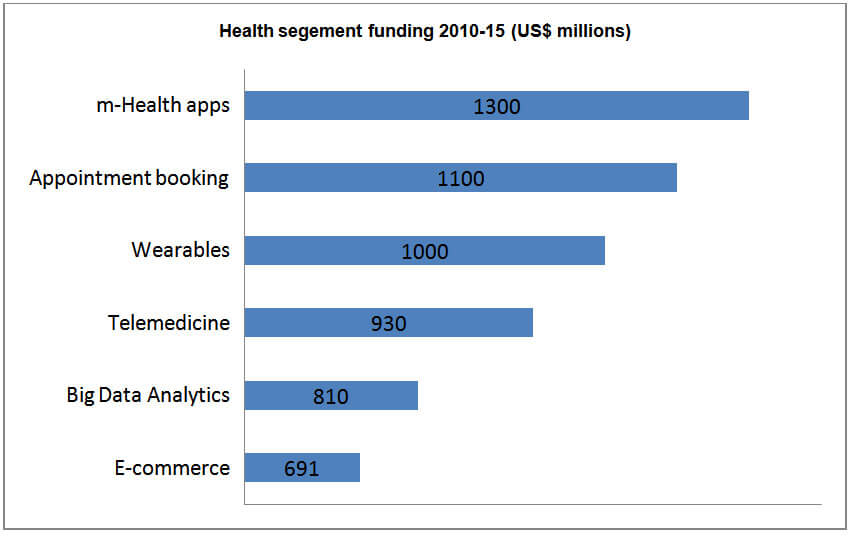

Why are some segments more attractive than others?

Local investors and digital start-ups in India have mainly focused e-commerce, appointment setting and telemedicine services. While other segments like mHealth, Wearables & Big Data are getting attention from the global investors.

In the current scenario, mHealth Apps and Wearables are in demand because of mobile and gadget revolutions that were seen in recent years. The young generation in India quickly attracted gets by fashion trends and wearables showing fitness levels is gaining grounds in digital healthcare. Similarly, mobiles apps are driving people online with over 900 mobile connection and 150+ million smart-phone users. Digital healthcare startups are focusing on these factors to draw people’s attention towards healthcare apps like mHealth.

Appointment booking is another segment where investors are investing in a significant amount, because of the huge amount of scope. Startups are trying to offer people with end-to-end solutions to book appointments via mobile apps, online portal, etc. Recently, startups like Practo India and CrediHealth, helped patients to connect customers to doctors and hospitals, and help them book appointments too.

Telemedicine is among top segments in Digital healthcare in India. Mobile apps & Social media are seen as means to tackle India’s ineffective & unproductive healthcare services via telemedicine.

Data analytics and E-commerce Pharma is expected to see growth in next few years as it assists reducing the inefficiencies in the pharmaceutical supply chain, which is troubled by the non-availability of medicines and resources. Anxieties over lack of innovative players, an unsteady market & regulatory difficulties have resulted in the subdued interest of investors in Indian health start-ups.

However, start-ups can take advantage of the current trend by entering into these sections and pursue more funding from global PE & VE firms.

Image credit: www.istockphoto.com